As Business Line of Credit vs Business Loan: Key Differences takes center stage, this opening passage beckons readers with a casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In the realm of business financing, understanding the disparities between a business line of credit and a business loan is crucial for making informed decisions.

In conclusion, the distinctions between a business line of credit and a business loan offer unique advantages and considerations for businesses seeking financial assistance. By grasping these variances, businesses can navigate their funding options adeptly and drive their ventures towards success.

In conclusion, the distinctions between a business line of credit and a business loan offer unique advantages and considerations for businesses seeking financial assistance. By grasping these variances, businesses can navigate their funding options adeptly and drive their ventures towards success.

Business Line of Credit

A business line of credit is a flexible financing option that allows businesses to borrow funds up to a predetermined limit. It works similar to a credit card where the borrower can access funds as needed and only pay interest on the amount used.Examples of When a Business Line of Credit is Typically Used

- Managing cash flow fluctuations

- Purchasing inventory

- Meeting short-term operational expenses

Advantages of Using a Business Line of Credit for Financing Needs

- Flexibility in accessing funds

- Interest is only paid on the amount used

- Ability to use funds for various business needs

- Builds credit history for the business

Business Loan

A business loan is a sum of money borrowed by a business entity from a financial institution or lender, with the agreement to repay the borrowed amount along with interest over a specified period. Business loans are typically used for specific purposes such as starting a new business, expanding operations, purchasing equipment, or covering operational expenses.Situations where a business loan may be more suitable:

- When a business needs a large sum of money upfront for a specific investment or project.

- For long-term financing needs that require a fixed repayment schedule.

- When the business is in a growth phase and needs funds to expand its operations.

Process of applying for a business loan and typical requirements:

Applying for a business loan involves several steps, starting with researching and selecting a suitable lender based on interest rates, terms, and loan amount. The typical requirements for a business loan application may include:- A detailed business plan outlining the purpose of the loan and how it will be utilized.

- Financial statements such as income statements, balance sheets, and cash flow projections.

- Personal and business credit history to assess creditworthiness.

- Collateral in some cases to secure the loan.

- Legal documents such as business licenses, registrations, and tax returns.

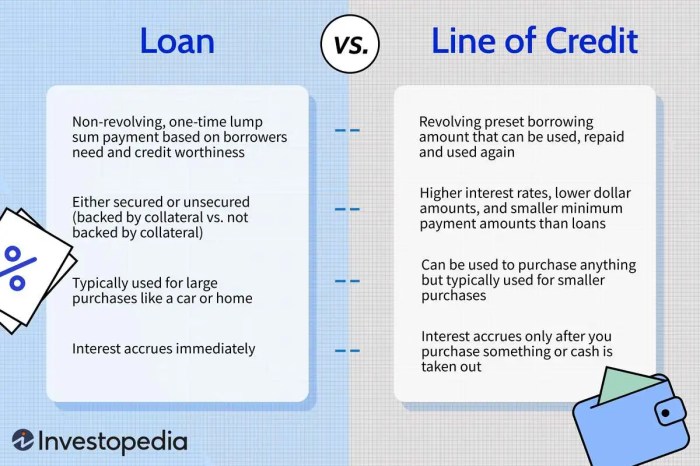

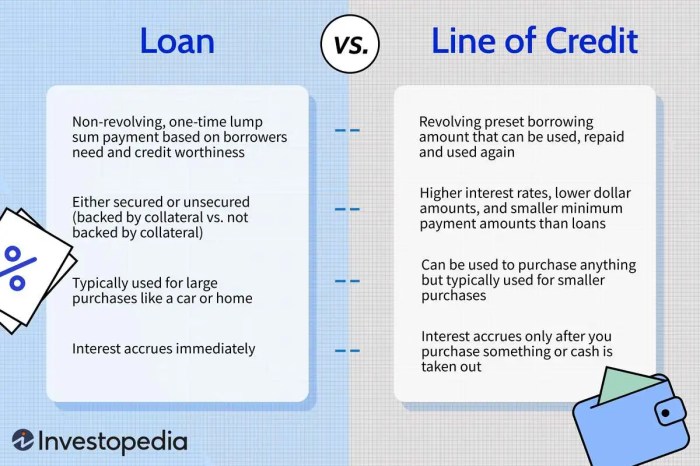

Key Differences in Terms of Flexibility

When comparing a business line of credit to a business loan, one key aspect to consider is the flexibility each option offers in terms of accessing funds and managing financial needs. Let's explore how the flexibility of these financial products can impact a business's financial management.Access to Funds

- A business line of credit provides businesses with a revolving credit limit that they can draw from as needed, similar to a credit card. This flexibility allows businesses to access funds whenever required, up to the approved limit.

- On the other hand, a business loan provides a lump sum amount upfront, which must be paid back over a set period with fixed monthly payments. This lack of flexibility in accessing additional funds can be a limitation for businesses with fluctuating financial needs.

Interest Payments

- With a business line of credit, businesses only pay interest on the amount they have borrowed, providing flexibility in managing interest costs based on the actual funds utilized.

- Contrastingly, a business loan typically comes with a fixed interest rate applied to the entire loan amount, regardless of how much of the funds are actually used. This lack of flexibility can result in higher interest costs for businesses.

Financial Management Scenarios

- In scenarios where a business has unpredictable cash flow or seasonal fluctuations in revenue, a business line of credit can offer greater flexibility in managing short-term financial needs without committing to a fixed repayment schedule.

- However, for businesses with a specific investment project or purchase in mind that requires a large, one-time sum of money, a business loan might be a more suitable option due to its structured repayment terms and fixed interest rates.

Interest Rates and Repayment Terms

When considering financing options for your business, understanding the differences in interest rates and repayment terms between a business line of credit and a business loan is crucial to making an informed decision.Interest Rates

- Business Line of Credit: Interest rates for a business line of credit are typically variable and are based on the prime rate plus a certain percentage. This means that the interest rate can fluctuate over time based on market conditions.

- Business Loan: Business loans usually have fixed interest rates, which means that the rate remains the same throughout the term of the loan.

Repayment Terms

- Business Line of Credit: With a business line of credit, you have the flexibility to borrow and repay funds as needed, similar to a credit card. You only pay interest on the amount you borrow, and once you repay the borrowed amount, that credit becomes available to use again.

- Business Loan: Business loans have set repayment terms, usually in the form of monthly payments over a fixed period of time. The loan is gradually paid off with each installment, including both principal and interest.

Strategies for Managing Interest Rates and Repayment Schedules

- For a business line of credit, managing interest rates involves monitoring market conditions and being prepared for potential rate fluctuations. Utilizing the credit wisely and paying off the borrowed amount promptly can help minimize interest costs.

- When it comes to a business loan, exploring options to refinance at a lower rate if available can help reduce overall interest expenses. Additionally, making extra payments towards the principal can shorten the repayment term and save on interest in the long run.

Impact on Credit Score and Credit History

When it comes to choosing between a business line of credit and a business loan, it is important to consider how each option can impact your company's credit score and credit history. Let's delve into the details to understand the implications of these financing choices.Credit Score Impact

Taking out a business line of credit can have a different impact on your credit score compared to a business loan. With a business line of credit, your credit score may not be affected as much initially since you only draw funds as needed and repay them. On the other hand, a business loan involves a lump sum amount which can impact your credit utilization ratio and credit score more significantly.Credit History Implications

Utilizing a business line of credit or a business loan can have lasting effects on your credit history. Timely repayments on either financing option can help build a positive credit history for your business. However, missed payments or defaulting on either of these financing products can negatively impact your credit history and make it harder to secure credit in the future.Tips for Maintaining a Healthy Credit Score

Make timely payments Ensure you make timely payments on your business line of credit or loan to maintain a positive credit score. Monitor your credit utilization Keep an eye on your credit utilization ratio and try to keep it low to avoid negatively impacting your credit score. Review your credit report Regularly check your credit report for any errors or discrepancies that could affect your credit score. Limit new credit applications Avoid applying for multiple new lines of credit within a short period as this can lower your credit score. Establish a credit history Building a solid credit history by responsibly managing your business finances can help improve your credit score over time.Final Thoughts

In conclusion, the distinctions between a business line of credit and a business loan offer unique advantages and considerations for businesses seeking financial assistance. By grasping these variances, businesses can navigate their funding options adeptly and drive their ventures towards success.

In conclusion, the distinctions between a business line of credit and a business loan offer unique advantages and considerations for businesses seeking financial assistance. By grasping these variances, businesses can navigate their funding options adeptly and drive their ventures towards success.